Enterprise Lending Platform — End-to-End Product Design

Designing a unified experience for lending operations for the Product Suite

Note: Organization name and references anonymized under NDA

🧭 Overview

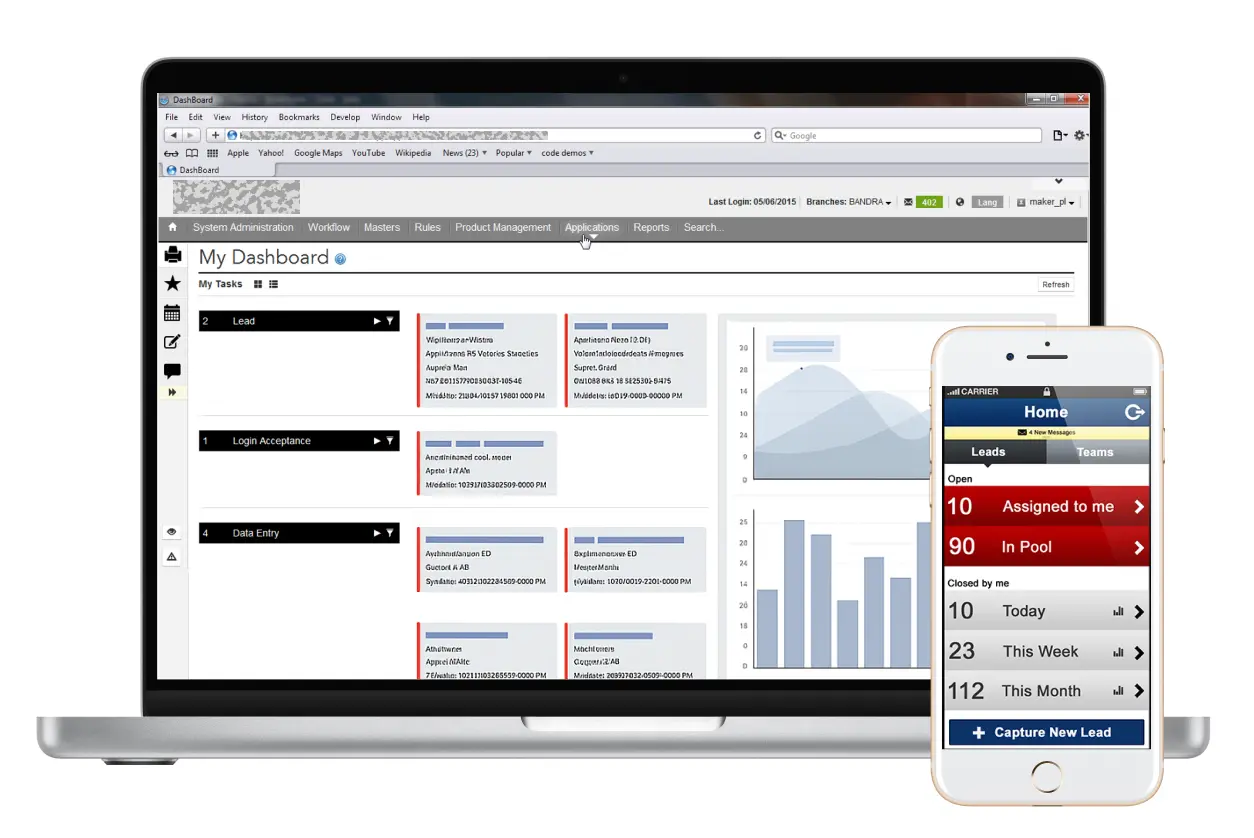

Designed a next-generation loan lifecycle management platform for a global financial software provider.

The goal was to replace legacy systems with a modern, scalable, cross-platform solution supporting customer acquisition, underwriting, servicing, and collections across multi-currency, multi-lingual, multi-tenant environments.

🧩 Problem Statement

Legacy systems were:

- Fragmented and difficult to maintain

- Visually inconsistent and slow

- Heavy on manual decisioning and redundant workflows

- Difficult to scale across branches and regions

Financial institutions needed a configurable lending platform aligned with evolving regulatory and operational needs.

🎯 Project Objectives

- Build a modular platform adaptable across global markets

- Deliver a responsive, device-agnostic UI

- Streamline the end-to-end lending journey

- Develop a reusable design system

- Reduce training effort and increase adoption through simplified UX

👤 Role & Contributions

Role: UX Designer & UI Developer

Duration: 2+ years

Team: Product Owners, BAs, Developers, QA, UX

Key Contributions

- Helped establish the organization’s UX practice and UCD culture

- Led IA, interaction design, and visual UI for core modules

- Designed responsive layouts for desktop, tablet, and mobile

- Supported UI engineering for design–dev alignment

- Contributed to branding & internal team identity initiatives

🧠 UX Vision

“Turn complex financial workflows into clear, confident, efficient experiences.”

Principles:

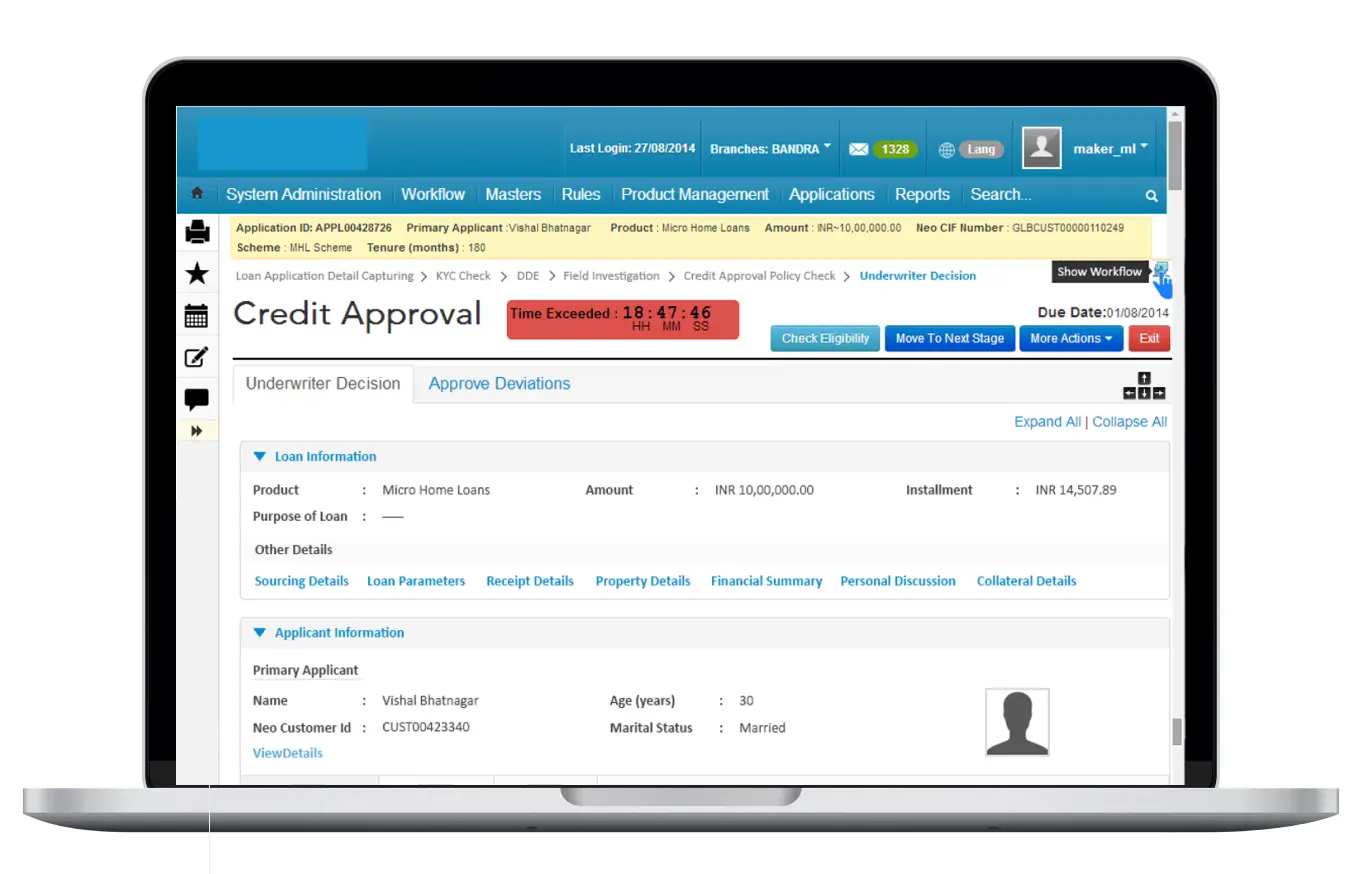

- Break long tasks into guided steps

- Reduce cognitive load using progressive disclosure

- Prioritize clarity and system feedback

- Build modular, scalable interfaces

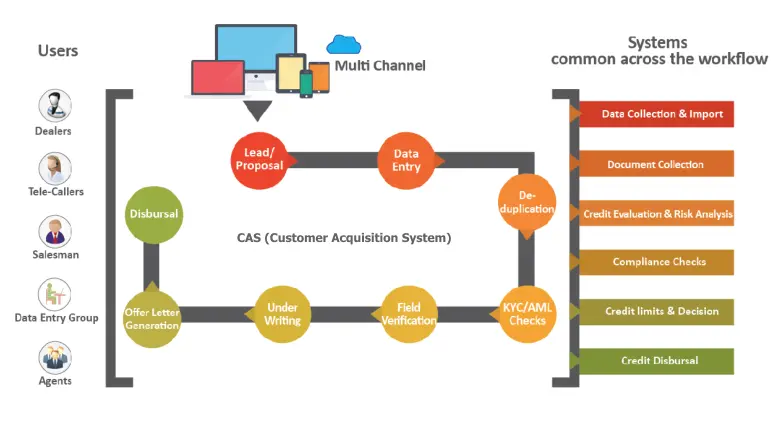

🧱 Core Modules

- CAS: Lead creation, KYC, credit scoring

- LMS: Servicing, payments, modifications

- Collections: Delinquency tracking and recovery

- FAS: Loans against securities

- Analytics: Dashboards and predictive insights

- Mobility Suite: Field officer app for sourcing and verification

🔍 Discovery & Research

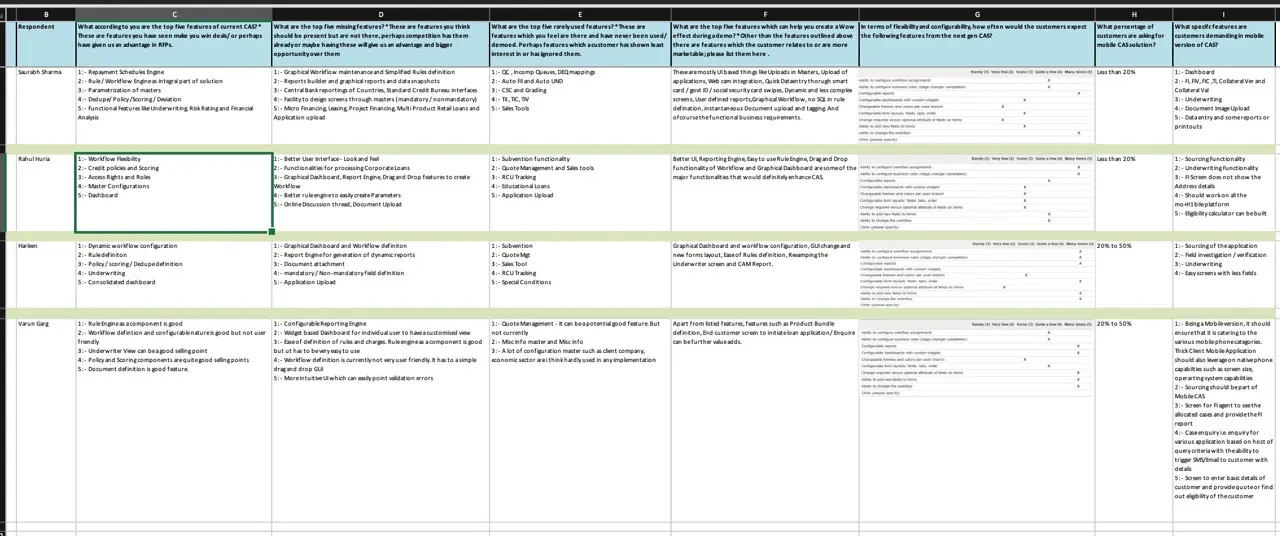

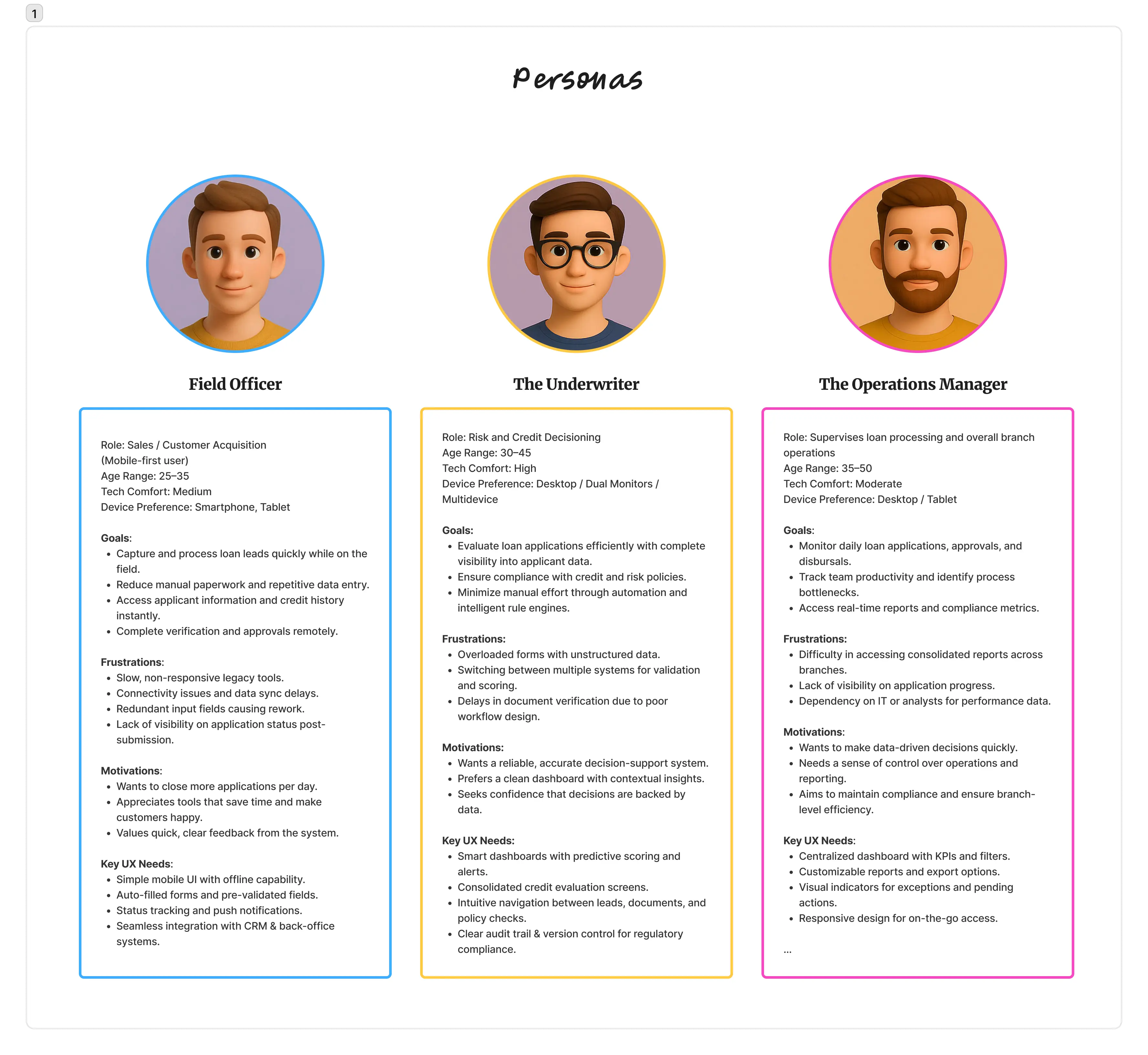

Methods:

- Focus group discussions

- Contextual interviews with loan officers, underwriters, and operations staff

- Heuristic evaluation of legacy system

- Workflow mapping with product and compliance teams

- Competitor benchmarking of digital lending products

👤 Personas

💡 Key Findings

| Insight | Problem | UX Opportunity |

|---|---|---|

| Manual decisions slowed approvals | Siloed rules | Visual scoring + rule templates |

| Rigid workflows delayed progress | No status visibility | Stage-based workflow tracker |

| High training effort | Dense UI, jargon | Guided onboarding |

| Role confusion | Shared dashboards | Role-based home screens |

Additional learnings:

- 20% of features drive 80% of tasks → prioritize core flows

- Visual indicators drive trust

- A single customer summary view improves clarity

- Workflow visualization improves collaboration

🧠 UX Design Strategy

Four UX Pillars

| Pillar | Focus | UX Approach |

|---|---|---|

| Credit Decisioning | Rule-based evaluation | Scoring visualization + configurable rules |

| Workflows | Process clarity | Workflow editor + progress tracker |

| Usability & Customization | Flexibility | Widget-based UI + themes |

| Security & Integration | Trust | Clear API feedback & authentication UX |

🔄 As-Is vs To-Be

As-Is (Legacy)

- Hard-coded workflows

- Dense, outdated UI

- Manual scoring

- File-based integrations

- Code-dependent customization

To-Be (Redesigned)

- Visual workflow builder

- Widget-based interface

- Configurable rule engine

- API-driven integration

- Interactive dashboards

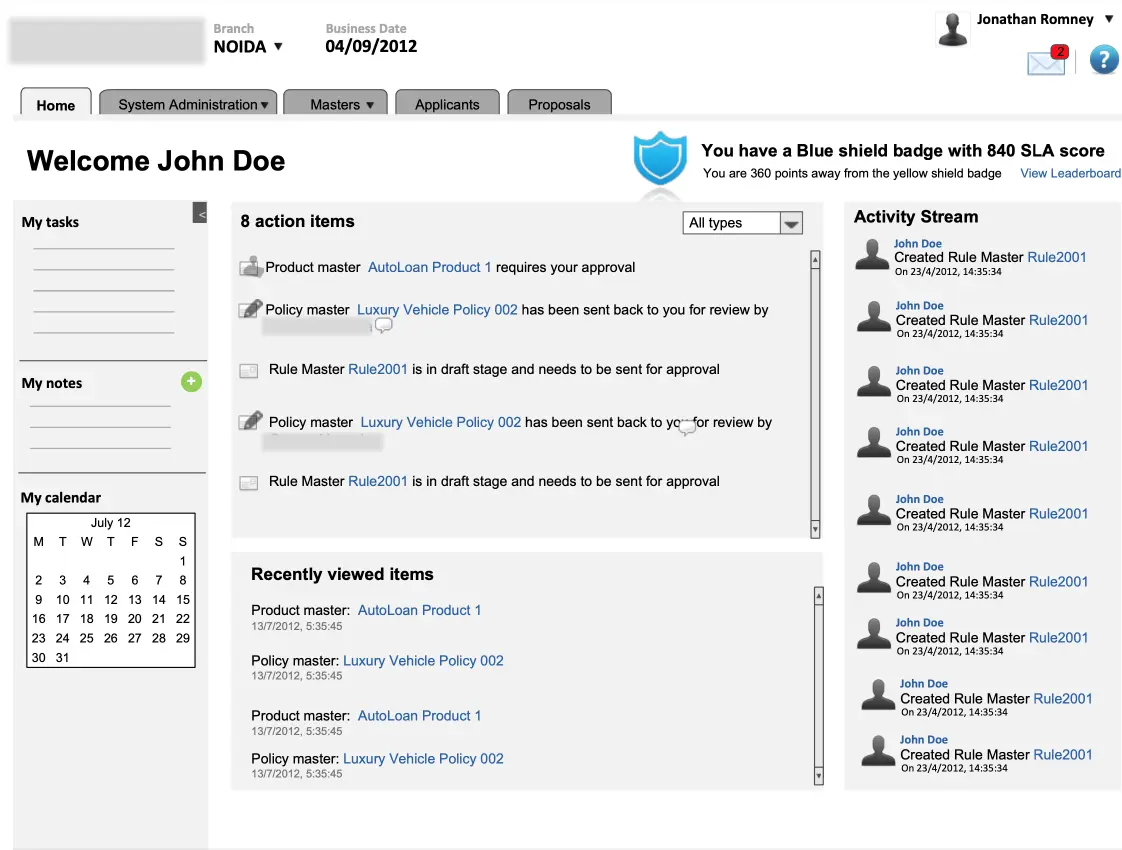

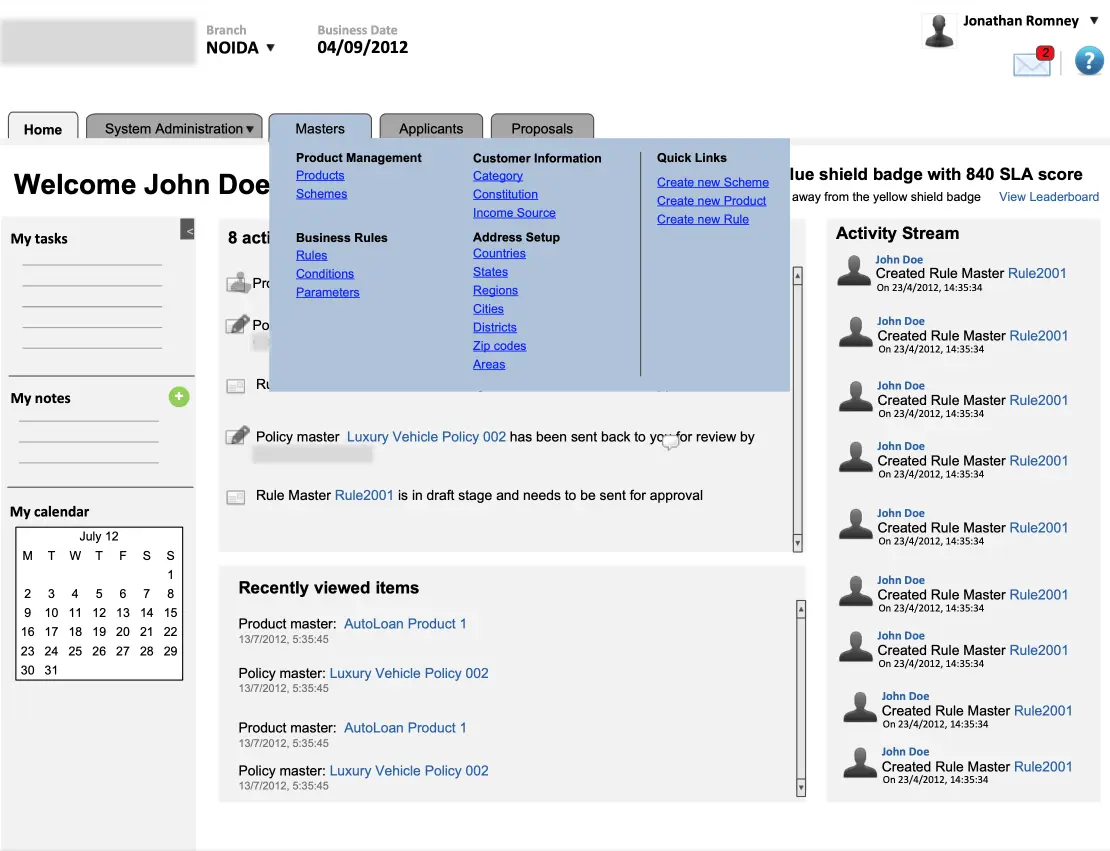

🗺️ Information Architecture

- Unified modules into role-based dashboards

- Added search-driven actions

- Designed layouts for multi-device, multi-language use

- Introduced context-aware toolbars for faster actions

🎨 Design System: NEON

- Atomic design system (Bootstrap-based)

- Reusable widgets, forms, tables, dashboards

- White-label palette customization

- Documented typography, spacing, behaviors

- Version-controlled libraries for each release

✏️ Wireframes & Prototypes

- Started with sketches → wireframes → high-fidelity prototypes

- Validated with BAs and regional banking teams

- Designed responsive prototypes for web, tablet, and mobile

- Iterated quickly using demo-driven feedback

⚙️ Key UX Features

- Adaptive multi-branch workflows

- Role-specific dashboards

- Drag and Drop Rule engine editor

- Visual scoring insights

- Optimized performance for both low-bandwidth and high-speed networks

- White label and brand specific theming flexibility

- Cross browser and device agnostic application

🧪 Usability Testing

Improvements

- 60–70% faster task completion

- Significant drop in errors

- Clearer navigation through guided steps

- Higher user confidence due to better visibility & feedback

📈 Business Impact

- Faster loan processing

- Shorter time-to-market for new financial products

- Improved branch-level adoption

- Localization-ready for international expansion

- Reusable UX framework for future modules

- Strengthened brand image with new suite launch

💬 Learnings

- UX + UI Dev synergy strengthens product alignment

- Early validation prevents costly redesign

- UCD culture is essential in enterprise development

- Modular design ensures future scalability

- Persistence and strategic vision are critical in multi-year product builds

Core Innovation Team - CAS Dev

Core Innovation Team - CAS Dev

✨ Conclusion

This project transformed a complex, fragmented lending system into a cohesive, configurable, and user-centered financial platform.

Through structured UX strategy, modular design, and iterative validation, the platform now supports faster workflows, intelligent decisions, and global scalability — creating long-term value for both the organization and its clients.